Arkansas Tax Calculator

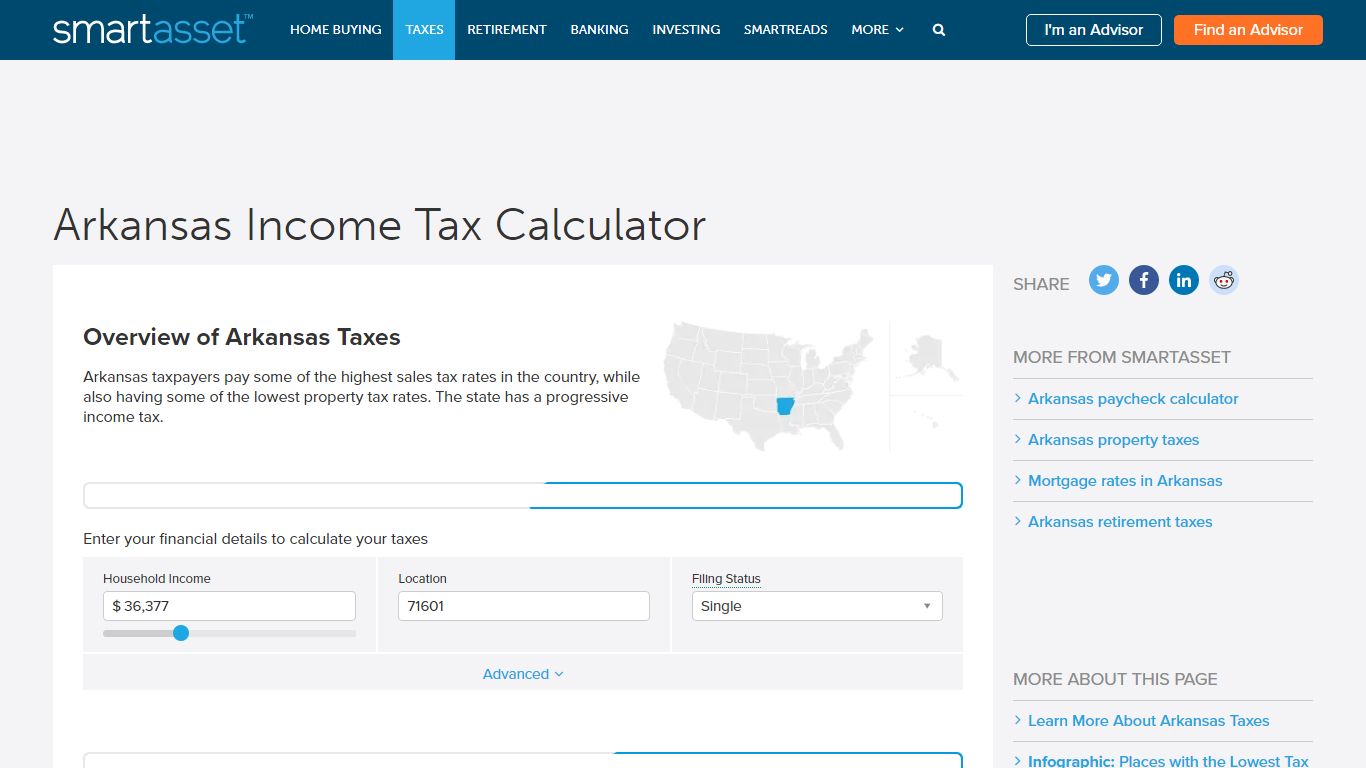

Arkansas Income Tax Calculator - SmartAsset

Arkansas Gasoline Tax. The gas tax in Arkansas is 24.5 cents per gallon of regular gasoline and 28.5 cents per gallon of diesel. Arkansas Estate Tax. Arkansas has no estate or inheritance tax. Inheritances is also exempt from the Arkansas income tax. Arkansas Capital Gains Tax. Capital gains are taxable as personal income in Arkansas. That means you pay the same income tax rates as you do for other income in the state.

https://smartasset.com/taxes/arkansas-tax-calculator

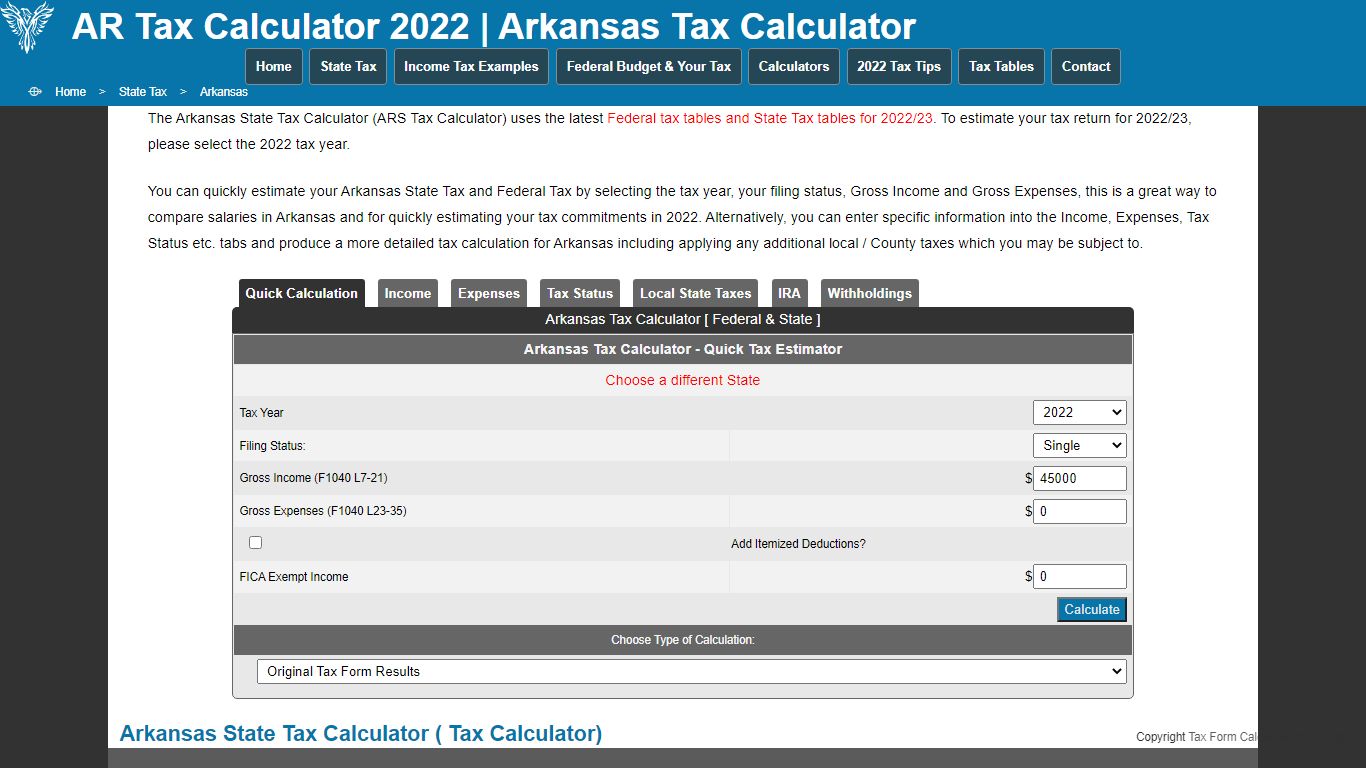

Arkansas Tax Calculator

The Arkansas State Tax Calculator (ARS Tax Calculator) uses the latest Federal tax tables and State Tax tables for 2022/23. To estimate your tax return for 2022/23, please select the 2022 tax year. You can quickly estimate your Arkansas State Tax and Federal Tax by selecting the tax year, your filing status, Gross Income and Gross Expenses, this is ...

https://www.taxformcalculator.com/state-tax/arkansas.html

Arkansas Tax Calculator: Estimate Your Taxes - Forbes Advisor

Income Tax Calculator 2021 Arkansas Arkansas Income Tax Calculator 2021 If you make $70,000 a year living in the region of Arkansas, USA, you will be taxed $12,387. Your average tax rate is 11.98%...

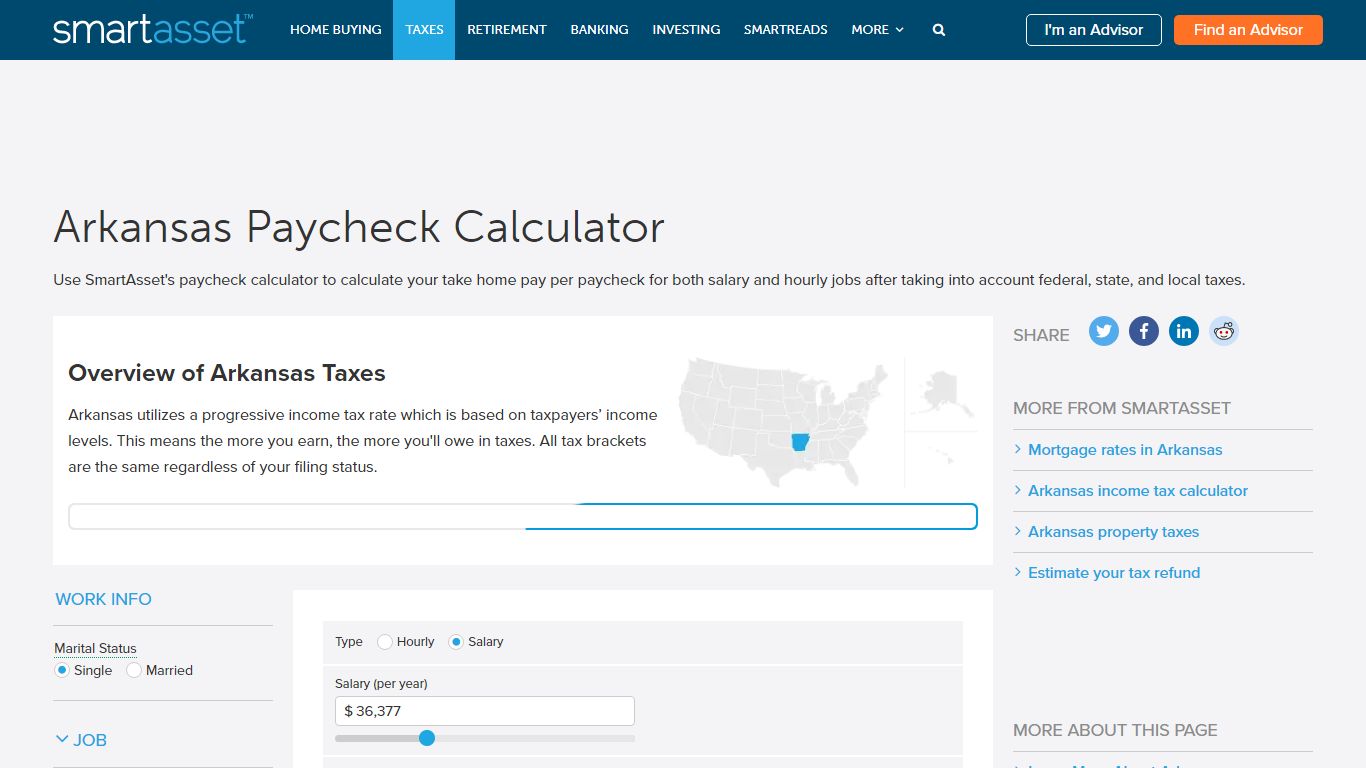

https://www.forbes.com/advisor/income-tax-calculator/arkansas/Arkansas Paycheck Calculator - SmartAsset

Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Overview of Arkansas Taxes. Arkansas utilizes a progressive income tax rate which is based on taxpayers’ income levels.

https://smartasset.com/taxes/arkansas-paycheck-calculator

Arkansas State Tax Calculator - Good Calculators

To use our Arkansas Salary Tax Calculator, all you have to do is enter the necessary details and click on the "Calculate" button. After a few seconds, you will be provided with a full breakdown of the tax you are paying. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

https://goodcalculators.com/us-salary-tax-calculator/arkansas/

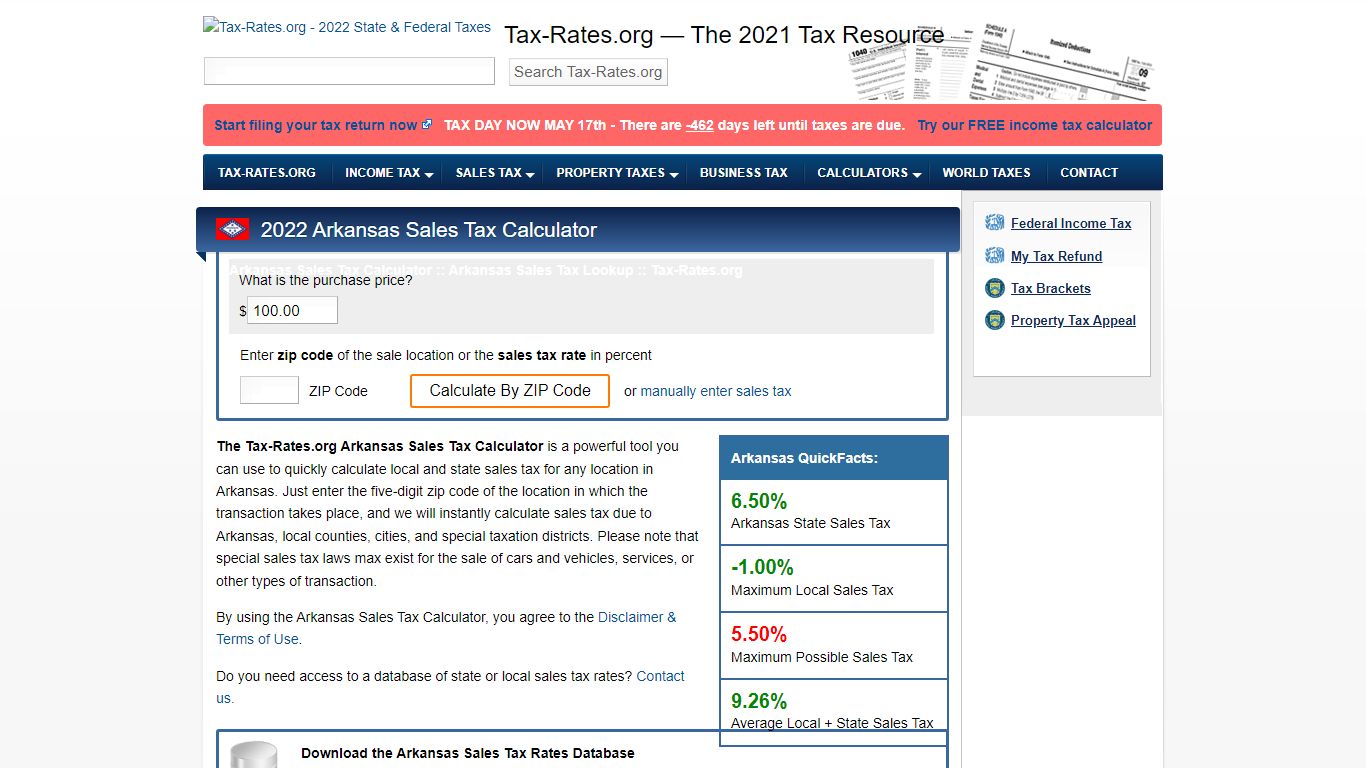

Arkansas Sales Tax Calculator - Tax-Rates.org

The Tax-Rates.org Arkansas Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Arkansas. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Arkansas, local counties, cities, and special taxation districts.

https://www.tax-rates.org/arkansas/sales-tax-calculator

Arkansas Sales Tax Calculator - SalesTaxHandbook

Arkansas has a 6.5% statewide sales tax rate, but also has 409 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.627% on top of the state tax. This means that, depending on your location within Arkansas, the total tax you pay can be significantly higher than the 6.5% state sales tax.

https://www.salestaxhandbook.com/arkansas/calculator

Arkansas Income Tax Calculator - Investomatica

The state income tax rate in Arkansas is progressive and ranges from 0% to 5.9% while federal income tax rates range from 10% to 37% depending on your income. This income tax calculator can help estimate your average income tax rate and your salary after tax. How many income tax brackets are there in Arkansas?

https://investomatica.com/income-tax-calculator/united-states/arkansas

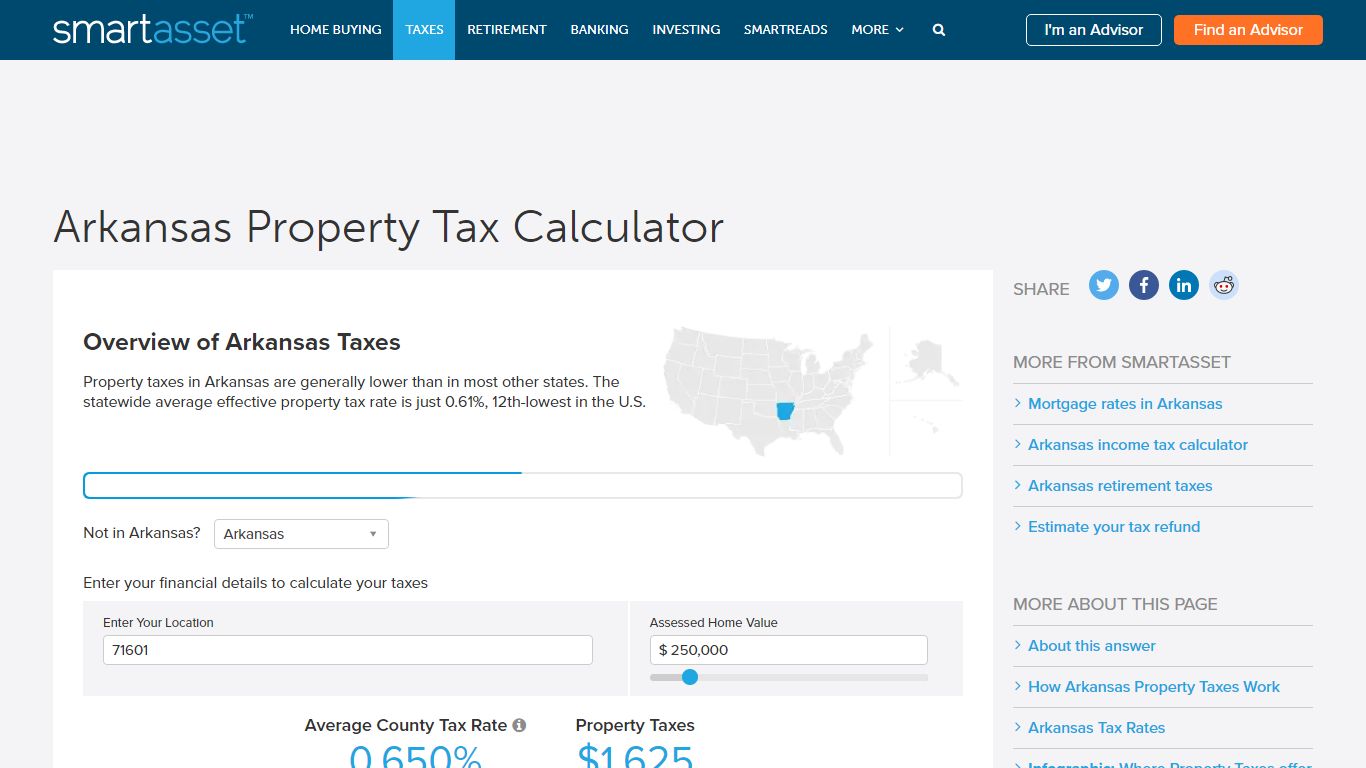

Arkansas Property Tax Calculator - SmartAsset

Tax rates in Arkansas are applied in terms of mills. A mill is equal to 1/1,000, or one tenth of a percent. So if your tax rate is 30 mills and your assessed value is $20,000, your property tax bill would be $600. That’s $20,000 x (30/1,000). The millage rates in Arkansas vary by county, city and school district.

https://smartasset.com/taxes/arkansas-property-tax-calculator

Free Arkansas Payroll Calculator | 2022 AR Tax Rates | OnPay

As an employer in Arkansas, you have to pay unemployment insurance to the state. The 2022 rates range from 0.3% to 14.2% on the first $10,000 in wages paid to each employee in a calendar year. If you’re a new employer (congratulations on getting started!), you pay a flat rate of 3.1% (this is including a 0.3% stabilization tax).

https://onpay.com/payroll/calculator-tax-rates/arkansas

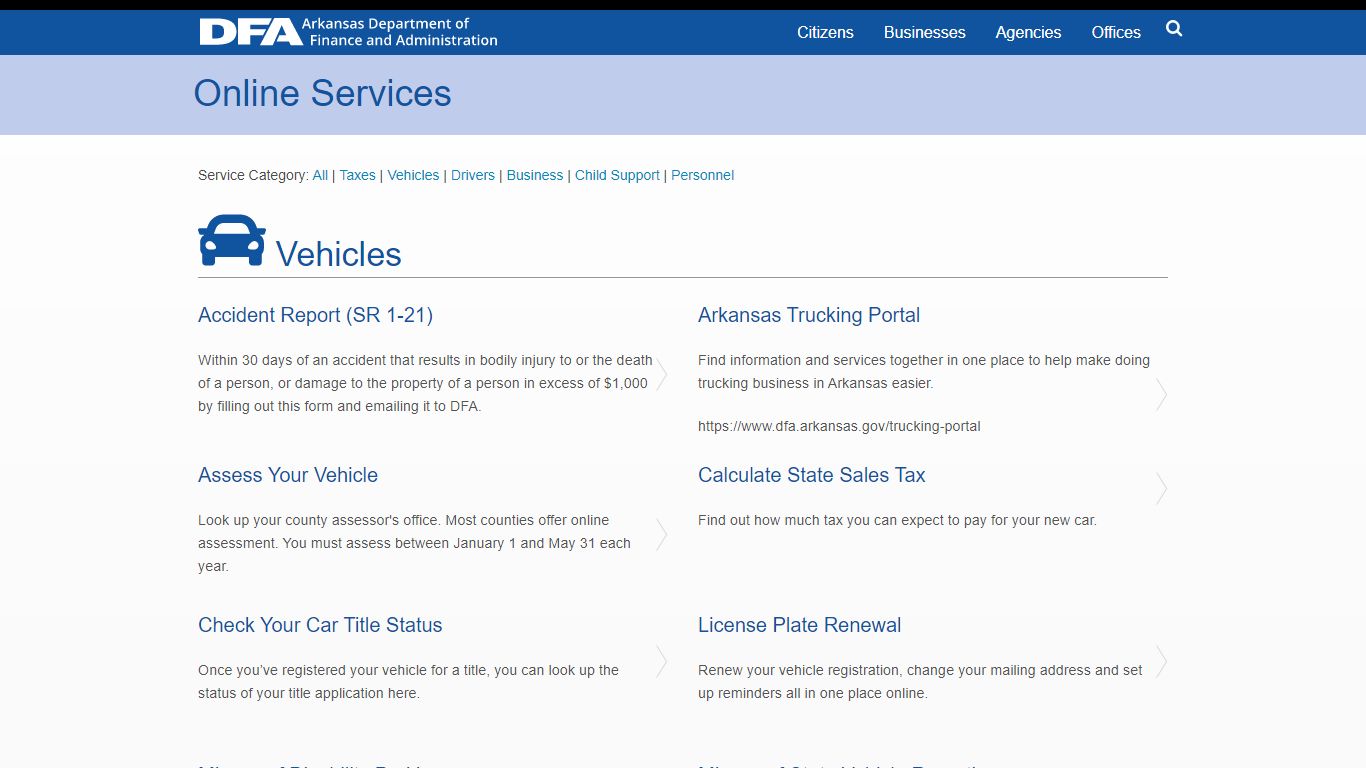

Vehicles | Department of Finance and Administration - Arkansas

Calculate State Sales Tax. Find out how much tax you can expect to pay for your new car. ... If you really want to pay your vehicle sales tax at the DMV, you can streamline your visit by pre-registering here. ... View all specialty license plates and placards available in Arkansas, including antique vehicle plates, college plates, organization ...

https://www.dfa.arkansas.gov/services/category/vehicles/